Kentucky Farm Bureau Things To Know Before You Get This

The smart Trick of Life Insurance That Nobody is Talking About

Table of ContentsThe Basic Principles Of Life Insurance Company Some Known Factual Statements About Life Insurance Companies Near Me The Main Principles Of Cancer Life Insurance Fascination About Term Life Insurance LouisvilleRumored Buzz on Life Insurance Companies Near Me

1 Definitions as well as Kinds of Insurance Understanding Objectives Know the basic kinds of insurance for individuals. Name and describe the various kinds of business insurance. A contract of compensation.The person or company insured by an agreement of insurance policy. (occasionally called the guaranteed) is the one that obtains the settlement, other than in the case of life insurance, where payment goes to the recipient called in the life insurance policy contract.

See This Report on Life Insurance Company

Every state now has an insurance coverage division that looks after insurance policy rates, plan criteria, books, and also various other aspects of the sector. Over the years, these departments have come under fire in many states for being ineffective and also "slaves" of the industry. Huge insurance providers operate in all states, as well as both they and also consumers should contend with fifty different state governing systems that give extremely various degrees of security (Whole life insurance Louisville).

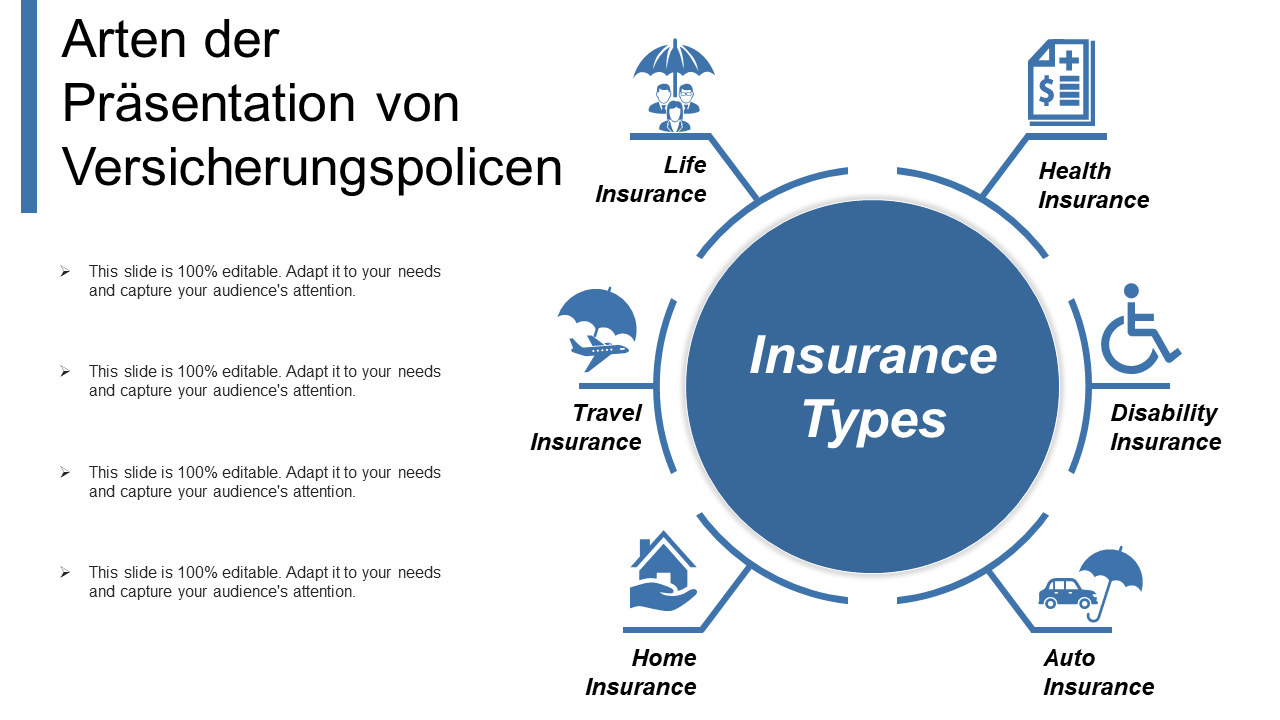

We begin with an overview of the kinds of insurance coverage, from both a customer and also an organization perspective. Then we take a look at in higher information the three crucial sorts of insurance coverage: building, responsibility, as well as life. Public and Private Insurance coverage Often a difference is made between public and private insurance policy. Public (or social) insurance policy consists of Social Safety and security, Medicare, short-lived impairment insurance coverage, and so on, funded with federal government plans.

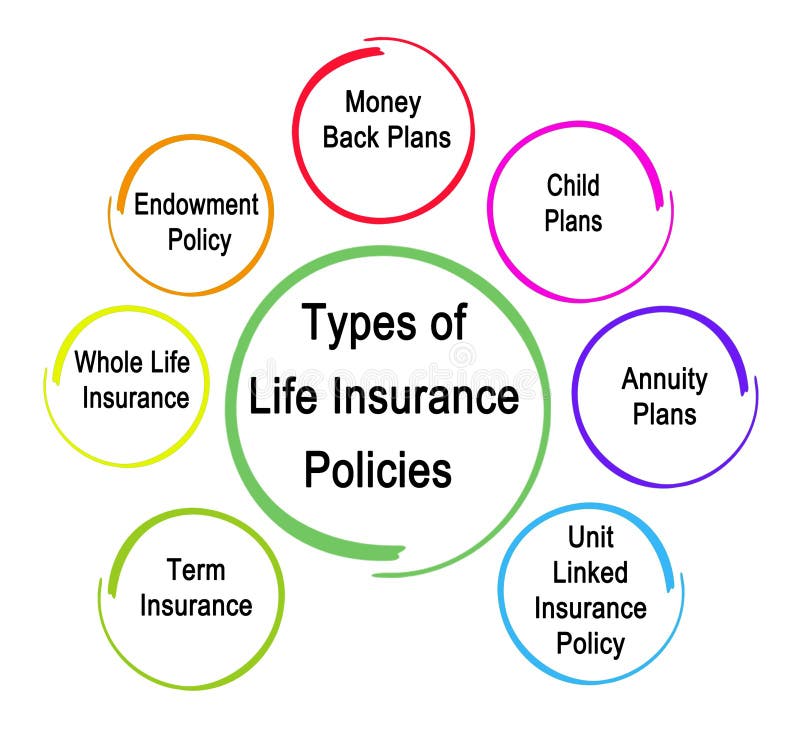

The focus of this phase is personal insurance policy. Kinds of Insurance for the Individual Life Insurance Life insurance policy attends to your household or a few other named recipients on your death. Two basic types are available: term insuranceLife insurance policy with a survivor benefit however no collected cost savings. provides protection just throughout the regard to the plan and pays off just on the insured's death; whole-life insurance coverageOffers savings in addition to insurance coverage and can allow the insured gather prior to fatality.

Whole Life Insurance Louisville Things To Know Before You Get This

Medical Insurance Wellness insurance coverage covers the expense of hospitalization, brows through to the medical professional's workplace, as well as prescription medicines. Life insurance quote online. One of the most valuable policies, given by lots of companies, are those that cover 100 percent of the costs of being hospitalized and also 80 percent of the charges for medicine and also a medical professional's solutions. Generally, the plan will include an insurance deductible amount; the insurance provider will certainly not pay until after the insurance deductible quantity has been reached.

Disability Insurance coverage A handicap plan pays a specific portion of a staff member's salaries (or a repaired amount) weekly or month-to-month if the staff member comes to be not able to overcome illness or a crash. Costs are reduced for plans with longer waiting periods prior to settlements should be made: a plan that starts to pay a handicapped employee within thirty days might set you back twice as high as one that postpones settlement for 6 months.

Facts About Life Insurance Online Revealed

Automobile Insurance policy Auto insurance policy is possibly the most commonly held kind of insurance - Whole life insurance. Vehicle plans are needed in at the very least minimum quantities in all states. The common vehicle policy covers liability for bodily injury as well as building damages, medical repayments, damage to or loss of the cars and truck itself, as well as lawyers' fees in instance of a suit.

An individual responsibility plan covers numerous types of these risks and also can give protection over of that supplied by house owner's and car insurance policy. Such umbrella protection is typically fairly economical, maybe $250 a year for $1 million in responsibility. Sorts Of Business Insurance Policy Employees' Compensation Virtually every company in every state must guarantee versus injury to employees on the work.

Rumored Buzz on Whole Life Insurance Louisville

Malpractice Insurance Coverage Professionals such as doctors, attorneys, and accountants will commonly acquire negligence insurance policy to protect against cases made by dissatisfied patients or clients. For doctors, the expense of such insurance has been rising over the past thirty years, largely because of larger jury awards against medical professionals that are negligent in the method of their profession.

Responsibility Insurance policy Organizations encounter a host of dangers that might result in considerable obligations. Several kinds of policies are available, consisting of policies for owners, property owners, and occupants (covering obligation sustained on the premises); for suppliers as well as specialists (for liability sustained on all facilities); for a firm's items as well as finished operations (for liability that arises from guarantees on products or injuries triggered by items); for owners as well as contractors (safety obligation for damages brought on by independent contractors involved by the guaranteed); as well as for legal responsibility (for failure to comply with efficiencies required by certain contracts) (Whole life insurance Louisville).

Today, a lot of insurance is available on a bundle basis, through solitary policies that cover one of the most important threats. These are typically called multiperil policies. Secret Takeaway Although insurance policy is a requirement for each United States organization, and several go to this site companies run in all fifty states, regulation of insurance coverage has actually remained at the state degree.